An online payment gateway is a mode of the technical way of payment that transfers the payment information from a customer to a merchant's bank account online.It's a technology that is used by merchants to accept debit cards or credit card purchases from customers.In stores, an online payment gateway consists of the Point Of Sale (POS) terminals that are used to accept credit card details by card or smartphone.And in online stores, an online gateway is the checkout portal used to give credit card information for services.The procedure for an online payment gateway to receive payments from customers, they required to fill in some details like credit or debit card number, expiry date, CVV number, and name on the card.

With many amazing payment gateways in the market, how do you have any idea about which one to pick? The choice is a major one. This is why we have reviewed the list of the best payment gateway in India which will assist you in improving the online payment experience.

Let's take a look at that

Types of Online Payment Gateway :

There are three types of online payment gateway

- Redirect : In this payment gateway it simply takes a customer to a payment processor to process the transaction.

- Hosted (off-site payment): In this payment gateway customers purchase on your site or at your retail shop, and the payment details proceed forward to the merchant's servers for processing.

- Self-Hosted (on-site payment): In this payment gateway the entire transaction occurs on your servers.

Importance of payment gateways in India

The rise of e-commerce has led to a massive increase in online transactions in India. Payment gateways play a crucial role in facilitating these transactions, enabling businesses to accept payments from customers without the need for physical cash. With the government's push for digital payments through initiatives such as the Unified Payments Interface (UPI), payment gateways have become even more important in India.

How to choose the best payment gateway in India?

Whenever you are proceeding to an online payment gateway, there are some queries that you should search:

- Is it available in your country and those of customers ?

- Is it a Payment Card Industry (PCI) complaint for online payments?

- Does it easily integrate with your site, financial software, and POS?

- Which payment methods does it accept?

- Does it preserve monetary facts stable thru encryption and different methods?

- Does it cover your customer's needs?

- Does it provide functions your commercial enterprise is looking for?

for more details, you have to read our related blog how to choose the best payment gateway for your business

How does an Online Payment Gateway work?

When a customer places an order for a product from a payment gateway, it follows a procedure for settling the payment every time through these step

STEP 1: After the customer places the order online and proceeds to make payment for the same, they need to enter credit/debit card detais.

STEP 2: The card details are encrypted securely with Secure Socket Layer (SSL) encryption to be sent between the browser and the merchant’s web server.

STEP 3: After this, the service provider forwards transaction information to their payment gateway.

STEP 4: The payment gateway converts the message from XML to ISO 8485 or a variant message format (format understood by EFT Switches) and then forwards the transaction information to the payment processor utilized by the service provider`s obtaining bank.

STEP 5: The payment processor forwards the transaction information to the card association I.e.: Visa card, MasterCard, etc.

STEP 6: Next, the credit score card issuing bank gets the authorization request, verifies the credit or debit card available, after which sends a reaction lower back to the processor (thru the system equal as for the authorization) with a reaction code i.e., authorized or denied.

STEP 7: The processor then forwards the authorization reaction to the payment gateway, and the payment gateway gets the reaction and forwards it onto the interface used to system the price. This system is called Authorization or “Auth”.

STEP 8: The service provider then fulfills the order and the above system may be repeated however this time to “Clear” the authorization through consummating the transaction. This outcomes withinside the issuing bank `clearing` the `auth` (I.e. movements auth-maintain to a debit) and prepares them to settle with the service provider obtaining bank.

STEP 9: The service provider submits all their authorised authorizations, in a “batch” (quit of the day), to their obtaining bank for agreement through its processor.

STEP 10: The obtaining bank makes the batch agreement request of the credit score card company.

STEP 11: The credit card issuer makes a settlement payment to the acquiring bank.

STEP 12: The acquiring bank subsequently deposits the total of the approved funds into the merchant’s account (the same day or the next day). This will be an account with the obtaining bank if the service provider does their banking with the equal bank or an account with some other bank.

Read our Popular Articles related to Payment Gateway

| The Future of Payment Gateways | How to Choose The Best Payment Gateway for your Business |

| Payment Gateways vs. Mobile Wallets |

Top 10 Payment Gateways in India :

1. PayPal :

Paypal will show to be your virtual pockets with the exceptional integrated functions. It comes with a 180-day refund policy, free return shipping, top-notch protection to your financial details, one-touch login.

2. Stripe :

Stripe is one of the exceptional payment software program, which lets you run an internet commercial enterprise. It provides you most powerful tools for online business. Stripe’s designed APIs you to create the best product for your users while creating a subscription service, an on- demand marketplace, and an e-commerce store.

3. Amazon Payments :

Amazon Payment is one of the best online payment gateways in India. It offers you a secure and streamlined payment service to its clients. The service is available to both merchants and shoppers to facilitate their online purchases. It works by using a user’s Amazon account information, to complete check-ins and checkouts.

4. PhonePe :

PhonePe is one of the best and most secure online payment gateways in India. PhonePe is Indian digital payments and financial technology company headquartered in Bengaluru, Karnataka, India. PhonePe changed into based in December 2015, via way of means of Sameer Nigam, Rahul Chari, and Burzin Engineer. PhonePe is accepted as a payment option at over 2.5 crore offline and online merchant outlets in India.

, and Burzin Engineer. PhonePe is accepted as a payment option at over 2.5 crore offline and online merchant outlets in India.

5. Cashfree Payments :

Cashfree is a one-forestall bills solutions suite for businesses. It has noticeably superior functions like routine payments, reconciliation, refunds, on the spotaneous settlement, etc.

6. PayUBiz :

PayU Biz is an enterprise payment gateway product for e-commerce companies from PayU. PayU India serves more than 4000 merchants including leading e -commerce companies like Goibibo, Jabong, Snapdeal, Bookmyshow, Travelyaari, Zomato Groupon India, etc.

7. Razorpay :

Razorpay is one of the exceptional payment gateways in India. Its futuristic functions take care of quit to quit the transaction in a count of minutes. An intuitive payment gateway software program to streamline transactions.

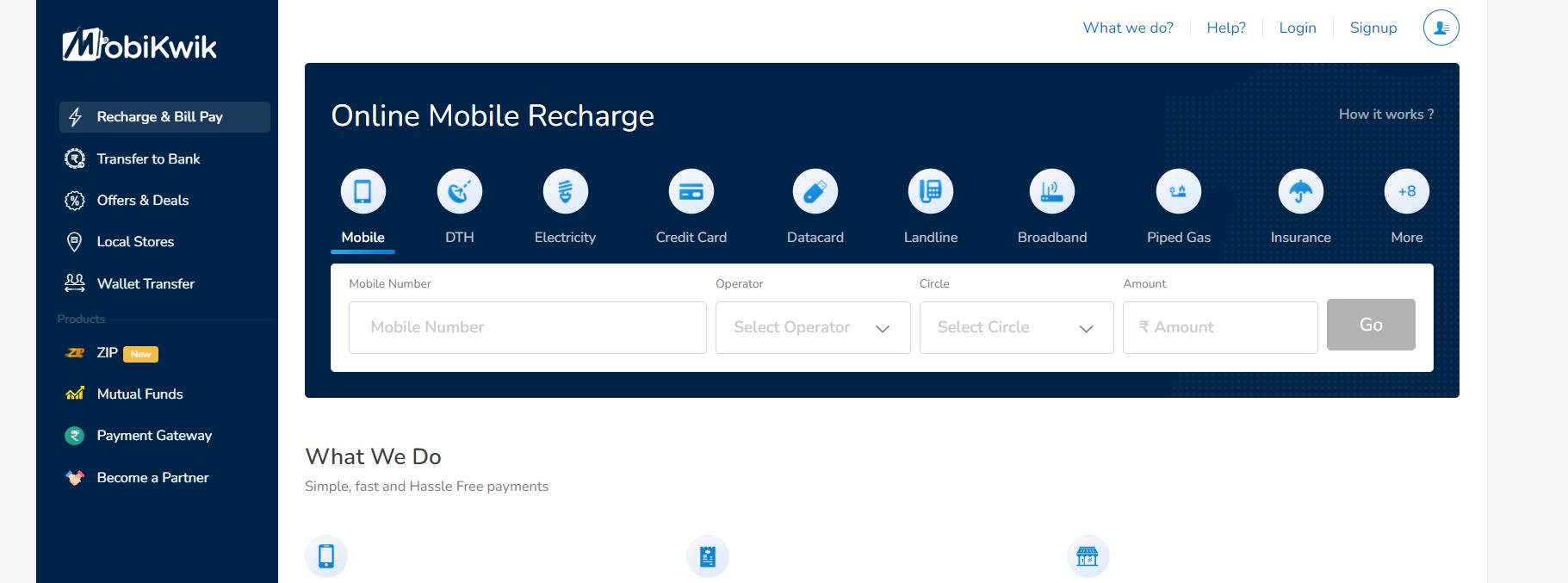

8. MobiKwik :

MobiKwik is online mobile recharge Network, with fast and safe payment. These are Android, Windows and iOS. All services of MobiKwik are also available via a desktop site and a mobile site.

9. Gpay :

Gpay is one of the leading payment gateways in India. Gpay is also known as Google Pay. Google Pay uses near-field communication (NFC) to transmit card information facilitating funds transfer to the merchant.

10. Paytm :

Paytm is another one of the best payment gateways in India. It was founded in 2000 by Vijay Shekhar Sharma. It offers payments services to consumers and merchants.

Leave a reply

Categories

You may like these blogs

-

Online Learning System

An online learning system, also known as an e-learning...

View Details -

The Future of Payment Gateways

The world of payment gateways is continuously evolving,...

View Details -

Payment Gateways vs. Mobile Wallets

In today's digital age, payment options are...

View Details -

What is Fintech

Fintech is the term "financial technology" that...

View Details -

Concepts of Cloud Computing

Cloud computing is a model for delivering computing...

View Details -

What is Session Hijacking?

Before going into the details of the session hijacking,...

View Details